In April 2017, New York State enacted bill 7116-A to encourage property owners in the City of Jamestown to invest in their vacant or condemned homes. This legislation established a tax exemption program for those willing to undertake rehabilitation, updates, expansions, or improvements to their outdated or deteriorating properties. This presents an opportunity for property owners to invest in their homes without incurring additional property tax responsibilities. The Department of Development is enthusiastic about collaborating with you to enhance your home and improve the surrounding neighborhood.

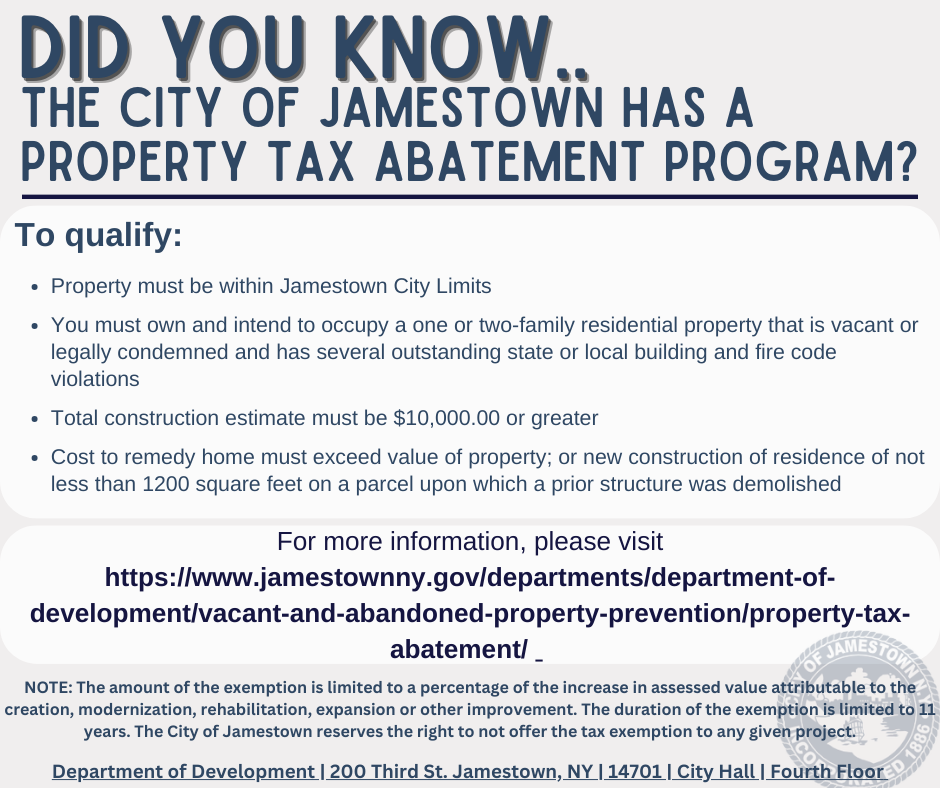

To qualify for the tax exemption program in the City of Jamestown, certain criteria must be met:

- Property must be located within Jamestown City Limits.

- You must own and intend to occupy a one or two-family residential property that is either vacant or legally condemned and has multiple outstanding state or local building and fire code violations.

- The total construction estimate must be $10,000.00 or more.

- The cost to remedy the home must exceed the value of the property, or new construction of a residence with a minimum of 1200 square feet on a parcel where a previous structure was demolished.

- All construction and rehabilitation efforts must adhere to state and local fire and building codes.

- The application and scope of work must undergo review by the municipal housing code enforcement officer and the appropriate fire and building code enforcement officer.

- Contractors, plumbers, and electricians providing cost estimates and quotes must be licensed to operate within the municipality.

Please note:

- The amount of the exemption is limited to a percentage of the increase in assessed value attributed to the creation, modernization, rehabilitation, expansion, or other improvement.

- The duration of the exemption is limited to 11 years.

- The City of Jamestown reserves the right to decline offering the tax exemption to any given project

Helpful Links:

- Additional Project Scope Form (Save Form to Computer First; Fill Out & Attach with RP-485-T when Submitting to Jamestown)

- Application for Partial Tax Exemption for Residential Construction Work in Certain Cities (RP-485-T Form)

- NYS Assembly Bill A07116

- NYS Department of Taxation & Finance